Delve into the realm of Cheap Full Coverage Car Insurance for Older Vehicles with this detailed guide. From understanding the factors influencing costs to strategies for finding affordable coverage, this article covers it all.

Unravel the importance of maintaining full coverage for older vehicles and debunk common misconceptions surrounding this topic. Let's navigate the world of insurance for older cars together.

Factors influencing the cost of full coverage insurance for older vehicles

When it comes to securing full coverage insurance for older vehicles, several factors come into play that can influence the cost of premiums. Let's delve into how the age of the vehicle, mileage, and the make and model impact insurance rates.

Age of the vehicle

The age of the vehicle is a significant factor in determining insurance rates for older vehicles. As a car ages, its value depreciates, which can lead to lower premiums for comprehensive and collision coverage. However, older vehicles may also be more prone to mechanical issues, increasing the risk of insurance claims and potentially raising insurance costs.

Mileage

Mileage is another crucial factor that insurance companies consider when calculating premiums for older vehicles. Higher mileage typically indicates more wear and tear on the vehicle, which can result in higher insurance rates. Vehicles with lower mileage may be perceived as lower risk, leading to potentially lower insurance costs.

Make and model of the vehicle

The make and model of an older vehicle play a significant role in determining insurance premiums. Some makes and models are more expensive to repair or replace parts for, leading to higher insurance rates. Additionally, safety features, theft rates, and overall reliability of the vehicle can impact insurance costs.

It's essential to consider these factors when insuring an older vehicle to ensure adequate coverage at a reasonable price.

Strategies to find affordable full coverage insurance for older vehicles

When it comes to finding affordable full coverage insurance for older vehicles, there are several strategies you can use to lower your premiums and get the best deal possible. From comparing quotes to bundling policies, these tips can help you save money without sacrificing coverage.

Comparing quotes from different insurance providers

- Get quotes from multiple insurance companies to compare prices and coverage options.

- Consider both national and local insurance providers to find the best rates.

- Look for discounts and special offers that may be available from different companies.

Bundling policies to reduce costs

- Consider bundling your auto insurance with other policies, such as home or renters insurance, to receive a discount.

- Ask your insurance provider about multi-policy discounts and savings opportunities for bundling.

- Review your coverage needs and consider consolidating all your insurance policies with one provider for additional savings.

Increasing deductibles to lower premiums

- Increasing your deductible can help lower your monthly premiums, but be sure to choose a deductible amount that you can afford to pay out of pocket in case of a claim.

- Consider the potential savings versus the increased financial risk before raising your deductible.

- Discuss your deductible options with your insurance agent to find the right balance between savings and financial protection.

Importance of maintaining full coverage for older vehicles

While some may think that full coverage is unnecessary for older vehicles, there are several reasons why it is important to maintain comprehensive and collision coverage for these cars.

Comprehensive and Collision Coverage for Protection

Comprehensive coverage protects your vehicle from non-collision related damages, such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, helps cover the cost of repairs if your car is damaged in an accident.

- Comprehensive coverage can be crucial for older vehicles that may be more susceptible to theft or damage.

- Collision coverage can help offset the cost of repairs that can be expensive for older cars due to potential scarcity of parts.

- Both coverages together provide a comprehensive safety net for unexpected events that could otherwise result in significant financial loss.

Benefits of Full Coverage Insurance for Older Vehicles

Having full coverage insurance for older vehicles can prove beneficial in various situations, such as:

- Protecting your investment: Even though the value of an older vehicle may be lower, the cost of repairs can still be substantial. Full coverage ensures you are financially protected.

- Peace of mind: Knowing that your car is covered for a wide range of risks can give you peace of mind and eliminate the stress of potential repair bills.

- Resale value: Maintaining full coverage can help maintain the resale value of your older vehicle, as it shows potential buyers that the car has been well taken care of.

Common misconceptions about full coverage insurance for older vehicles

When it comes to insuring older cars, there are several common misconceptions that people tend to have regarding full coverage insurance. These misconceptions can lead to confusion and potentially leave car owners vulnerable to financial risks.

Full coverage is unnecessary for older vehicles

Some individuals believe that full coverage insurance is unnecessary for older vehicles due to their depreciated value. They think that since the car is older and worth less, it is not worth investing in comprehensive coverage.

- However, it's important to remember that full coverage insurance not only protects the value of the car but also provides coverage for damages in accidents, theft, natural disasters, and other unforeseen events.

- Even older vehicles can be expensive to repair or replace, and without full coverage insurance, the owner may end up bearing the full cost of repairs or replacement.

Importance of full coverage for older vehicles

Contrary to the misconception that full coverage is unnecessary for older vehicles, it is crucial to maintain comprehensive insurance for these cars to ensure financial protection and peace of mind.

- Full coverage insurance can help cover repair costs in case of accidents, regardless of the age of the car.

- Older vehicles are still susceptible to theft, vandalism, and natural disasters, making comprehensive coverage essential to safeguard against these risks.

- Without full coverage insurance, car owners may face significant financial burdens in case of unforeseen events, potentially leading to costly out-of-pocket expenses.

Final Thoughts

In conclusion, Cheap Full Coverage Car Insurance for Older Vehicles is a crucial aspect of car ownership that shouldn't be overlooked. By grasping the nuances of insurance for older cars, you can make informed decisions that protect both your vehicle and your finances.

Q&A

Does the age of the vehicle impact insurance rates?

Yes, older vehicles generally have lower insurance rates compared to newer ones.

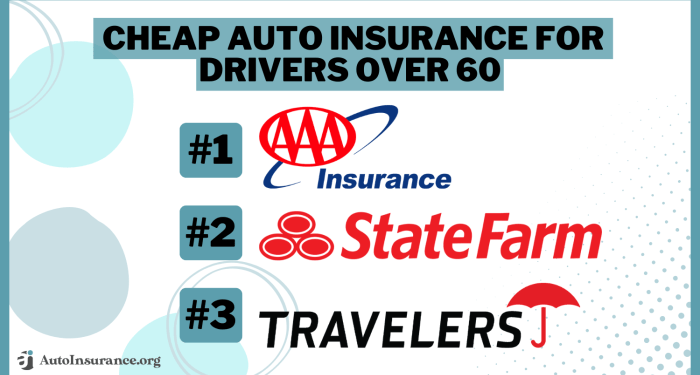

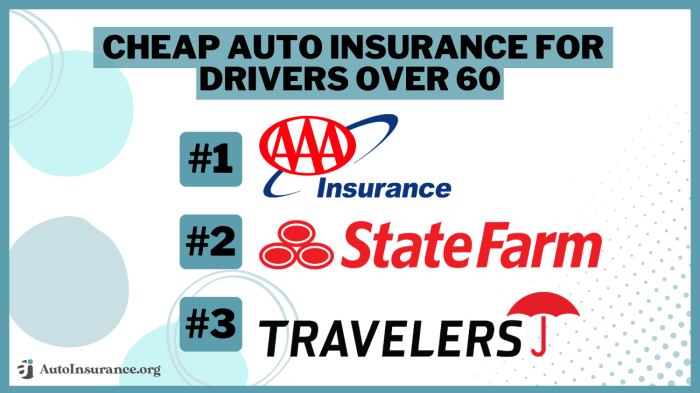

How can I find affordable full coverage insurance for older vehicles?

You can compare quotes from different providers, bundle policies, and consider increasing deductibles.

Is full coverage necessary for older cars?

Full coverage may still be essential to protect older vehicles from various risks.

What are some common misconceptions about insuring older cars?

Some believe full coverage is unnecessary for older vehicles, but it can offer valuable protection.