Exploring the intricacies of Commercial Auto Insurance Claims Process Explained, this introduction sets the stage for a detailed and informative discussion. From the basics to the complexities, readers will gain a thorough understanding of how commercial auto insurance claims work.

As we delve deeper into the various aspects of the claims process, you will uncover valuable insights that can help businesses navigate the often daunting world of insurance claims.

Overview of Commercial Auto Insurance Claims

Commercial auto insurance claims refer to the process where businesses file for coverage after an accident or damage involving vehicles used for commercial purposes. This type of insurance is crucial for businesses to protect their assets and financial stability in case of unexpected incidents on the road.A smooth claims process is vital for businesses to minimize disruptions and financial losses.

This involves timely communication, thorough documentation, and efficient handling of the claim by the insurance provider. With a well-managed claims process, businesses can quickly recover and resume operations after an accident.Key differences between commercial auto insurance claims and personal auto insurance claims include the higher coverage limits typically offered for commercial vehicles, as well as the complexities involved in assessing liability and damages for business-related accidents.

Commercial auto insurance claims often involve multiple stakeholders, such as employees, clients, and third parties, adding layers of complexity to the resolution process.Common types of commercial auto insurance claims include vehicle collisions, cargo damage, theft, vandalism, and bodily injury. These incidents can have significant financial implications for businesses, making it essential to have comprehensive insurance coverage and a reliable claims process in place to mitigate risks effectively.

Steps in the Commercial Auto Insurance Claims Process

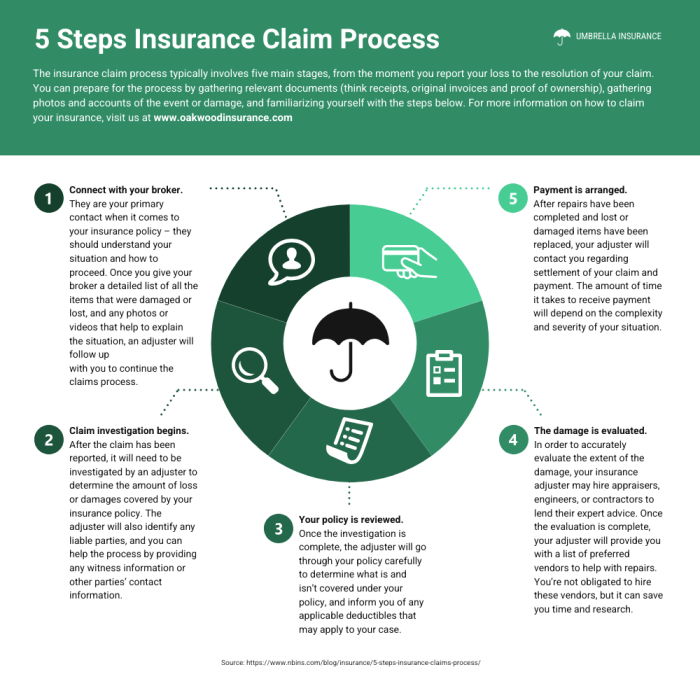

When it comes to filing a commercial auto insurance claim, there are specific steps that need to be followed to ensure a smooth process and timely resolution. Understanding these steps can help business owners navigate the claims process effectively.

Documentation Required During the Claims Process

- Proof of insurance coverage

- Details of the accident/incident

- Photos of the damages

- Police report (if applicable)

- Medical records (if injuries are involved)

Role of Adjusters and Investigators

- Adjusters assess the damages and determine the amount of compensation

- Investigators gather evidence and statements to determine fault

- Both play crucial roles in ensuring a fair and accurate claims process

Fault Determination in Commercial Auto Insurance Claims

- Insurance policies and state laws dictate how fault is determined in accidents

- Factors like traffic laws, witness statements, and evidence are considered

- Comparative negligence may also impact fault determination

Challenges Faced in Commercial Auto Insurance Claims

When it comes to filing commercial auto insurance claims, businesses often encounter various challenges that can impact the process and resolution of their claims.

Impact of Coverage Limits and Policy Exclusions

One common challenge faced by businesses is understanding how coverage limits and policy exclusions can affect their claims. Coverage limits may restrict the amount of compensation a business can receive for damages or losses, while policy exclusions can deny coverage for specific situations or types of accidents.

Complexities of Multi-Vehicle Accidents

Dealing with multi-vehicle accidents in commercial auto insurance claims can add another layer of complexity. Determining liability and allocating fault among multiple drivers and vehicles can prolong the claims process and lead to disputes.

Disputes During the Claims Process

Disputes are another challenge that may arise during the claims process. These disputes can involve disagreements over liability, coverage interpretation, or the extent of damages. Resolving these disputes often requires negotiation, mediation, or even legal action to reach a settlement.

Tips for Streamlining the Commercial Auto Insurance Claims Process

When it comes to navigating the commercial auto insurance claims process, efficiency is key. By implementing strategies to expedite the process, maintaining accurate records, communicating effectively with insurance companies, and minimizing disruptions to business operations, businesses can streamline the claims process and get back on track quickly.

Implementing Efficient Strategies

- Report the claim promptly: As soon as an incident occurs, notify your insurance company to initiate the claims process without delay.

- Document all details: Keep thorough records of the incident, including photos, witness statements, and police reports, to support your claim.

- Work with a dedicated claims adjuster: Establish a direct line of communication with your claims adjuster to expedite the evaluation and settlement of your claim.

Maintaining Accurate Records

- Keep organized records: Maintain a centralized system for storing all documentation related to the claim to ensure easy access and retrieval.

- Record all communication: Document all interactions with insurance company representatives in writing to avoid misunderstandings or disputes.

- Update information promptly: Provide any requested documentation or information to your insurance company in a timely manner to prevent delays in processing.

Effective Communication with Insurance Companies

- Be clear and concise: Clearly communicate the details of the incident and your claim without unnecessary embellishments or vague language.

- Ask questions when needed: Seek clarification on any aspects of the claims process or settlement offer that you do not understand to make informed decisions.

- Follow up regularly: Stay proactive by following up with your claims adjuster to ensure progress is being made and address any concerns promptly.

Minimizing Disruptions to Business Operations

- Implement contingency plans: Have backup vehicles or alternative transportation options in place to keep business operations running smoothly during repairs or downtime.

- Coordinate with service providers: Work closely with auto repair shops and other service providers to expedite the repair process and minimize business interruptions.

- Keep stakeholders informed: Communicate with employees, customers, and other stakeholders about the situation and any potential impact on operations to manage expectations and maintain trust.

Epilogue

In conclusion, Commercial Auto Insurance Claims Process Explained sheds light on a crucial aspect of business operations. By following the tips and understanding the challenges Artikeld in this guide, businesses can streamline their insurance claims process and protect their assets effectively.

Essential FAQs

What documents are typically required when filing a commercial auto insurance claim?

Documentation usually includes the police report, photos of the accident scene, driver information, and any witness statements.

How is fault determined in commercial auto insurance claims?

Fault is usually determined based on evidence such as witness statements, police reports, and the insurance company's investigation.

What are some common challenges faced by businesses during the claims process?

Businesses often struggle with coverage limits, policy exclusions, and disputes over fault or compensation amounts.

How can businesses expedite the commercial auto insurance claims process?

Keeping accurate records, cooperating with adjusters, and promptly providing required documentation can help speed up the process.

What are the best practices for communicating with insurance companies during a claim?

Clear and concise communication, keeping a record of all interactions, and promptly responding to any requests from the insurer are key practices.