Navigating the realm of Commercial Auto Insurance for Rideshare and Delivery Drivers opens up a world of crucial protection and coverage. This guide ensures a deep dive into the nuances of insurance for drivers in this unique segment, offering valuable insights and clarity for those seeking the right coverage.

In the following sections, we will explore the various coverage options, factors influencing premiums, legal requirements, and more, shedding light on essential aspects of commercial auto insurance tailored specifically for rideshare and delivery drivers.

Overview of Commercial Auto Insurance for Rideshare and Delivery Drivers

Commercial auto insurance is crucial for rideshare and delivery drivers as it provides coverage for accidents or incidents that may occur while they are working. Unlike personal auto insurance, which may not cover commercial activities, commercial auto insurance specifically caters to the unique needs of drivers who use their vehicles for business purposes.

Popular Insurance Providers

- GEICO Commercial Auto Insurance

- Progressive Commercial Auto Insurance

- Allstate Commercial Auto Insurance

Differences Between Personal and Commercial Auto Insurance

Personal auto insurance is designed for individuals who use their vehicles for personal use only, such as commuting to work or running errands. On the other hand, commercial auto insurance is tailored for drivers who use their vehicles for business purposes, including ridesharing or delivery services.

Commercial auto insurance typically offers higher coverage limits and additional protections to account for the increased risks associated with driving for business.

Coverage Options for Rideshare and Delivery Drivers

When it comes to commercial auto insurance for rideshare and delivery drivers, there are specific coverage options tailored to meet their unique needs. Let's explore the different types of coverage available and discuss the specific requirements for each category of drivers.

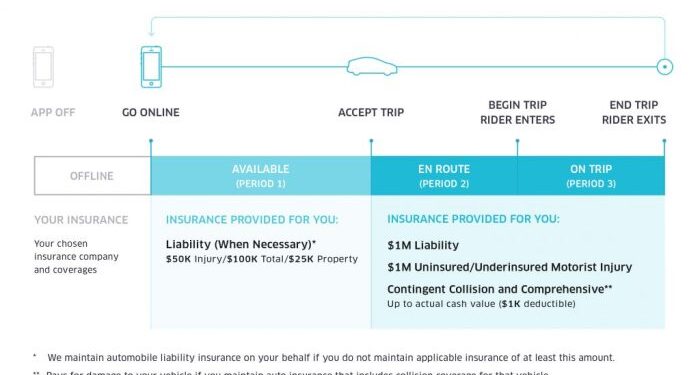

Rideshare Drivers Coverage

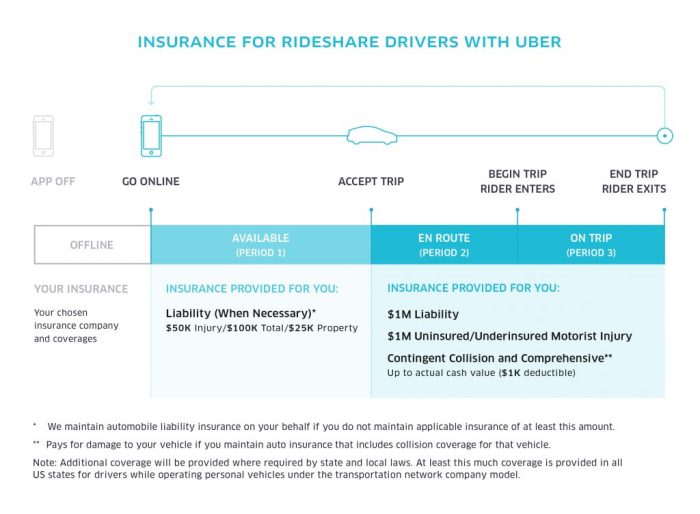

Rideshare drivers typically need coverage that bridges the gap between personal auto insurance and commercial coverage. Some key coverage options for rideshare drivers include:

- Liability Coverage: This protects drivers in case they are at fault in an accident while driving for a rideshare company.

- Uninsured/Underinsured Motorist Coverage: This covers the driver if they are involved in an accident with a driver who lacks sufficient insurance.

- Collision Coverage: This helps cover the cost of repairs or replacement of the driver's vehicle in case of an accident.

- Comprehensive Coverage: This provides coverage for non-collision incidents, such as theft, vandalism, or natural disasters.

Delivery Drivers Coverage

Delivery drivers have unique coverage needs due to the nature of their work. Some essential coverage options for delivery drivers include:

- Commercial Auto Liability: This coverage protects the driver in case they cause an accident while making deliveries.

- Hired and Non-Owned Auto Coverage: This extends coverage to vehicles that the driver may use for work purposes but do not own.

- Cargo Insurance: This coverage protects the goods or products being transported in case of damage or theft.

- Business Interruption Insurance: This helps cover lost income if the driver is unable to work due to a covered incident.

Coverage Limits and Policy Details

It is crucial for rideshare and delivery drivers to pay attention to coverage limits and policy details to ensure they have adequate protection. Some key considerations include:

- Understanding coverage limits to make sure they align with the driver's potential risks and liabilities.

- Reviewing policy exclusions to be aware of situations where coverage may not apply.

- Checking for any additional endorsements or riders that may be necessary to fill gaps in coverage.

- Being aware of any deductibles that apply and how they impact the cost of a claim.

Factors Influencing Premiums

When it comes to commercial auto insurance for rideshare and delivery drivers, several factors can influence the premiums they pay. Understanding these factors can help drivers make informed decisions to potentially lower their insurance costs.

Driving Records

A driver's record plays a significant role in determining insurance premiums. Drivers with a history of accidents or traffic violations are considered higher risk and may face higher premiums. On the other hand, drivers with clean records are likely to pay lower premiums.

Vehicle Types

The type of vehicle being used for rideshare or delivery services can also impact insurance premiums. Generally, newer and more expensive vehicles may come with higher premiums due to the cost of repairs or replacements. Additionally, the make and model of the vehicle, as well as safety features, can influence insurance rates.

Coverage Levels

The coverage levels selected by drivers also affect their insurance premiums. Opting for higher coverage limits and additional protections, such as comprehensive and collision coverage, can result in higher premiums. Drivers should carefully evaluate their coverage needs to strike a balance between protection and affordability.

Tips to Lower Premiums

- Maintain a clean driving record to demonstrate safe driving habits.

- Consider choosing a vehicle with lower insurance costs based on factors like make, model, and safety features.

- Review and adjust coverage levels periodically to ensure adequate protection without overpaying.

- Take advantage of discounts offered by insurance providers, such as safe driving discounts or bundling policies.

Legal Requirements and Regulations

Commercial auto insurance for rideshare and delivery drivers is subject to specific legal requirements and regulations to ensure the safety of passengers, other drivers, and pedestrians on the road. Without proper insurance coverage, drivers risk facing severe consequences, including fines, license suspension, or even legal action.

State Compliance

Each state has its own set of regulations regarding commercial auto insurance for rideshare and delivery drivers. It is crucial for drivers to familiarize themselves with the specific requirements in their state to ensure compliance. This may include obtaining additional insurance coverage beyond what is typically required for personal auto insurance.

- Drivers should review their state's insurance laws and regulations to determine the minimum coverage limits required for commercial auto insurance.

- Some states may mandate specific insurance providers or policies that drivers must use to operate legally.

- Drivers should regularly update their insurance information and ensure that they meet all state requirements to avoid any penalties or legal issues.

Consequences of Non-Compliance

Driving without proper commercial auto insurance as a rideshare or delivery driver can have serious consequences. In addition to potential legal penalties, uninsured drivers risk financial liability in the event of an accident or injury while on the job. Without adequate coverage, drivers may be personally responsible for damages, medical bills, and legal fees, leading to significant financial strain.

It is essential for rideshare and delivery drivers to prioritize compliance with state laws and regulations regarding commercial auto insurance to protect themselves and others on the road.

Last Point

As we conclude our exploration of Commercial Auto Insurance for Rideshare and Delivery Drivers, it becomes evident that safeguarding yourself with the right coverage is paramount in the fast-paced world of transportation services. With a firm understanding of insurance dynamics, drivers can navigate their journey on the road with confidence and peace of mind.

Frequently Asked Questions

What is the importance of commercial auto insurance for rideshare and delivery drivers?

Commercial auto insurance provides coverage tailored to the unique risks faced by rideshare and delivery drivers, ensuring financial protection in case of accidents or incidents during work.

What are the differences between personal auto insurance and commercial auto insurance for these drivers?

Personal auto insurance is not sufficient for rideshare and delivery drivers as it typically excludes coverage for business activities. Commercial auto insurance fills this gap by providing coverage specifically for work-related incidents.

How can drivers potentially lower their insurance premiums?

Drivers can potentially lower their insurance premiums by maintaining a clean driving record, choosing vehicles with safety features, and opting for higher deductibles.

What are the consequences of driving without proper commercial auto insurance in this sector?

Driving without proper commercial auto insurance can lead to legal penalties, financial liabilities in case of accidents, and potential loss of income due to lack of coverage.