As Term Life Insurance Quotes for Mortgage Protection takes center stage, this opening passage beckons readers with a captivating overview of the topic, setting the stage for an informative and engaging discussion ahead.

In the following paragraphs, we will delve deeper into the intricacies of term life insurance, mortgage protection, obtaining insurance quotes, factors to consider when choosing a policy, and the benefits of aligning insurance with mortgage payments.

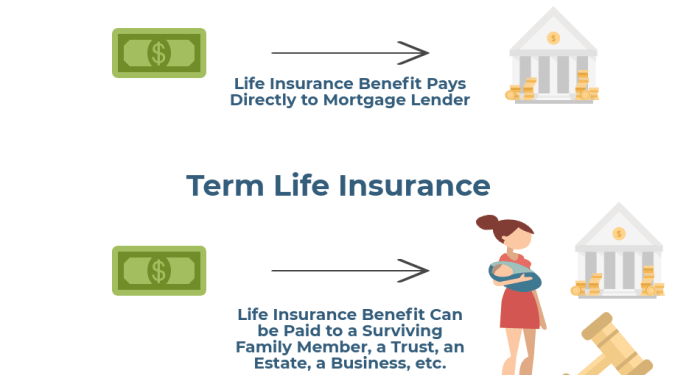

Understanding Term Life Insurance

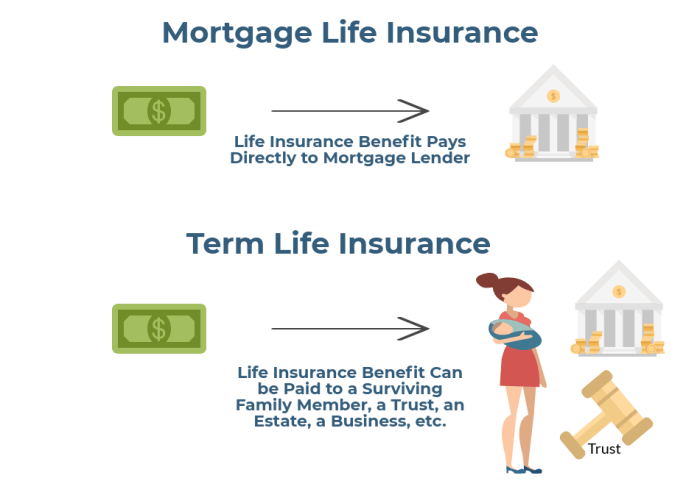

Term life insurance is a type of life insurance that provides coverage for a specific period of time, typically ranging from 10 to 30 years. In the event of the policyholder's death during the term, the beneficiaries receive a death benefit payout.Term life insurance differs from other types of life insurance, such as whole life insurance, in that it does not build cash value over time.

Instead, it is designed to provide coverage for a set period at an affordable premium.

How Term Life Insurance Works

- Policyholder selects a coverage amount and term length.

- Premiums are paid regularly to maintain coverage.

- If the policyholder passes away during the term, beneficiaries receive the death benefit.

- Once the term ends, the coverage expires unless renewed or converted to a permanent policy.

Importance of Mortgage Protection

When it comes to owning a home, one of the most significant financial responsibilities is paying off the mortgage. Mortgage protection plays a crucial role in ensuring that homeowners and their families are financially secure in the event of unforeseen circumstances.

Financial Security in Times of Crisis

Having mortgage protection provides a safety net for homeowners, especially during challenging times such as job loss, disability, or death. In such situations, the policy can help cover mortgage payments, preventing the risk of losing the home due to financial instability.

Peace of Mind for Homeowners

Knowing that mortgage protection is in place can offer peace of mind to homeowners, as they can rest assured that their loved ones will not face the burden of mortgage payments in case of an unexpected tragedy. This financial security allows families to focus on coping with the emotional challenges without added financial stress.

Real-Life Scenarios

- In the event of the primary breadwinner's sudden passing, mortgage protection can ensure that the surviving family members can stay in their home without worrying about losing it due to inability to make mortgage payments.

- If a homeowner becomes disabled and is unable to work, mortgage protection can step in to cover the mortgage payments until the individual is able to resume work or find an alternative solution.

- During times of economic downturn or job loss, mortgage protection can provide temporary relief by covering the mortgage payments until the homeowner is able to secure stable employment.

Obtaining Term Life Insurance Quotes

When it comes to obtaining term life insurance quotes for mortgage protection, there are a few key factors to consider. Whether you choose to get quotes online or through an insurance agent, understanding the process and what can impact the quotes you receive is crucial.

Methods of Obtaining Quotes

- Online: Many insurance companies offer the option to get term life insurance quotes online. This can be a quick and convenient way to compare prices and coverage options.

- Through an Agent: Working with an insurance agent allows you to get personalized guidance and recommendations based on your specific needs and financial situation.

Factors Impacting Quotes

- Age: Younger individuals typically receive lower quotes compared to older individuals due to lower risk of mortality.

- Health: Your overall health and any pre-existing medical conditions can impact the quotes you receive. Individuals with good health may receive lower quotes.

- Coverage Amount: The amount of coverage you choose will also impact the quotes. Higher coverage amounts will result in higher premiums.

- Term Length: The length of the term you choose for your policy can also affect the quotes. Longer terms generally have higher premiums.

Factors to Consider when Choosing a Policy

When selecting a term life insurance policy for mortgage protection, there are several important factors to consider to ensure adequate coverage and financial security.

Determining Coverage Amount for Mortgage Protection

- Calculate the outstanding balance of your mortgage: It is crucial to determine the exact amount needed to pay off your mortgage in case of your untimely death.

- Consider future expenses: Factor in additional costs such as property taxes, insurance premiums, and any other debts or financial obligations.

- Account for inflation: Adjust the coverage amount to account for inflation and ensure that the policy amount remains sufficient over time.

Significance of Policy Term Length

- Match the term length to your mortgage term: Select a policy term that aligns with the duration of your mortgage to ensure coverage until the loan is fully repaid.

- Consider your age and financial goals: Choose a term length that provides coverage until you reach a financially stable age or achieve certain financial milestones.

- Review your overall financial situation: Assess your current financial obligations and future financial plans to determine the appropriate policy term length.

Benefits of Aligning Insurance with Mortgage

When it comes to protecting your home and loved ones, aligning your insurance with your mortgage can offer several significant benefits. By specifically tailoring your term life insurance to cover your mortgage payments, you can ensure peace of mind and financial stability for your family in case of unexpected events.

Financial Security

- Having insurance aligned with your mortgage ensures that your loved ones can continue to live in the family home without the burden of mortgage payments in the event of your passing.

- It provides a safety net for your family, protecting them from potential financial hardship and allowing them to maintain their quality of life.

Peace of Mind

- Knowing that your mortgage is covered by insurance can relieve stress and anxiety about the future, allowing you to focus on enjoying time with your family.

- Having this financial security in place can offer peace of mind, knowing that your loved ones will be taken care of no matter what happens.

Preventing Financial Hardship

- If unexpected circumstances arise, such as the loss of a primary income earner, having insurance aligned with your mortgage can prevent your family from facing foreclosure or having to sell the family home.

- Insurance can provide a lifeline during difficult times, allowing your family to stay in their home and maintain stability during challenging situations.

Closing Summary

In conclusion, Term Life Insurance Quotes for Mortgage Protection offers a comprehensive look at the importance of securing your mortgage with the right insurance coverage. By understanding the nuances of term life insurance and its impact on mortgage protection, you can make informed decisions to safeguard your family's financial future.

Clarifying Questions

What factors can impact the quotes received for term life insurance?

Factors such as age, health condition, coverage amount, and term length can all impact the quotes received for term life insurance.

How should the coverage amount be determined for mortgage protection?

The coverage amount for mortgage protection should ideally be enough to cover the remaining mortgage balance in case of unforeseen circumstances.

What are the benefits of aligning term life insurance with mortgage payments?

Aligning term life insurance with mortgage payments ensures that your family can keep their home in case of your untimely passing, providing peace of mind and financial stability.