Exploring the intricacies of Cheap Auto Insurance Coverage Limits, this article aims to shed light on the importance of understanding coverage limits and how they impact your insurance policy. As we delve deeper into the world of auto insurance, you'll gain valuable insights to help you navigate the complex landscape of coverage options.

Understanding Cheap Auto Insurance Coverage Limits

When it comes to auto insurance, coverage limits refer to the maximum amount an insurance company will pay out for a specific type of coverage in the event of a claim. These limits are set by the policyholder when they purchase their insurance policy.

Coverage limits can directly impact insurance premiums. Higher coverage limits typically result in higher premiums because the insurance company will have to pay out more in the event of a claim. On the other hand, lower coverage limits can lead to lower premiums but may leave the policyholder exposed to more risk.

Types of Coverage Limits in Auto Insurance Policies

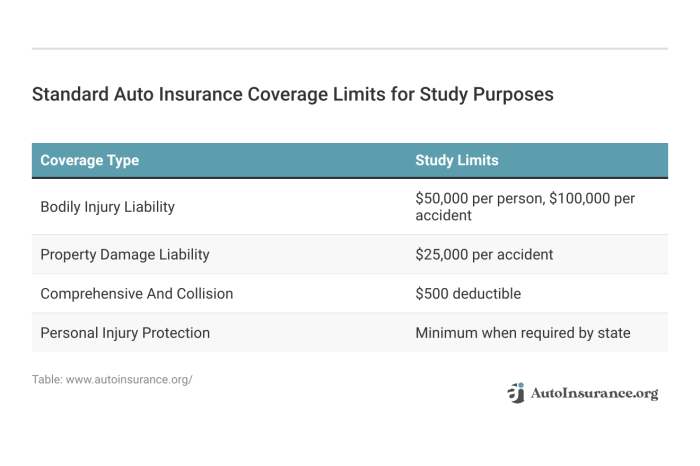

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and legal fees for the other party involved in an accident if you are at fault.

- Property Damage Liability: This coverage pays for damage to someone else's property, such as their vehicle or home, if you are at fault in an accident.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of fault in an accident.

- Uninsured/Underinsured Motorist: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your expenses.

Minimum vs. Recommended Coverage Limits

When it comes to auto insurance, understanding the difference between minimum coverage limits and recommended coverage limits is crucial. Minimum coverage limits are the lowest amount of coverage required by state laws to legally drive a vehicle. On the other hand, recommended coverage limits are the amounts of coverage that insurance experts suggest for adequate protection.

Minimum Coverage Limits Mandated by State Laws

In the United States, each state has its own minimum requirements for auto insurance coverage. For example, in California, drivers are required to have at least $15,000 in bodily injury liability coverage per person, $30,000 in bodily injury liability coverage per accident, and $5,000 in property damage liability coverage.

These minimum limits ensure that drivers have some level of financial protection in case of an accident.

Importance of Considering Recommended Coverage Limits

While meeting the minimum coverage limits is necessary to comply with the law, it may not always provide sufficient protection in the event of a serious accident. Insurance experts often recommend higher coverage limits to adequately protect you from financial loss.

For instance, increasing your liability coverage to $100,000 per person and $300,000 per accident can better safeguard your assets and provide more comprehensive coverage in case of a major accident. It's important to consider your financial situation, assets, and potential risks when deciding on coverage limits to ensure you have adequate protection.

Factors Influencing Auto Insurance Coverage Limits

When selecting auto insurance coverage limits, there are several factors that can influence the decision-making process. These factors can vary from personal circumstances to the type of vehicle being insured. Understanding these factors is crucial in determining the appropriate coverage limits for your specific needs.

Personal Factors Impacting Coverage Limit Decisions

- Age: Younger drivers, especially teenagers, are statistically more likely to be involved in accidents. This may result in higher coverage limits to protect against potential damages.

- Driving History: A clean driving record may lead to lower coverage limits, as it indicates a lower risk of accidents. On the other hand, a history of accidents or traffic violations may necessitate higher coverage limits.

- Location: Where you live can also play a role in determining coverage limits. Urban areas with higher traffic congestion and crime rates may require higher coverage limits to protect against theft, vandalism, or accidents.

Impact of Vehicle Type on Coverage Limits

- Value of the Vehicle: The value of the vehicle being insured can influence the choice of coverage limits. A newer, more expensive vehicle may require higher coverage limits to cover potential repair or replacement costs.

- Type of Vehicle: Certain types of vehicles, such as sports cars or luxury vehicles, may carry higher insurance premiums due to their increased risk of accidents or theft. This may necessitate higher coverage limits to adequately protect against potential losses.

- Usage of the Vehicle: The intended use of the vehicle, such as personal or commercial use, can also impact coverage limits. Commercial vehicles may require higher coverage limits to protect against liability claims in case of accidents while on the job.

Balancing Cost and Coverage

When it comes to auto insurance, finding the right balance between cost and coverage is crucial. While it's tempting to opt for the cheapest policy available, it's important to consider the potential risks of inadequate coverage. Here are some strategies to help you balance cost and coverage effectively.

Strategies for Balancing Cost and Coverage

- Compare quotes from multiple insurance providers to find the best value for your money.

- Consider raising your deductible to lower your premium, but make sure you can afford to pay it out of pocket in case of a claim.

- Review your coverage limits regularly to ensure they still meet your needs, especially after major life changes like buying a new car or moving to a new location.

- Look for discounts or bundling options that can help reduce your overall insurance costs without sacrificing essential coverage.

Risks of Opting for Excessively Low Coverage Limits

- Having insufficient coverage can leave you vulnerable to financial loss in the event of an accident, theft, or other covered incidents.

- State minimum coverage limits may not be enough to protect your assets or cover medical expenses in a serious accident.

- Opting for low coverage limits to save money could end up costing you more in the long run if you have to pay out-of-pocket for damages or legal fees.

Outcome Summary

In conclusion, Cheap Auto Insurance Coverage Limits are a crucial aspect of your insurance policy that should not be overlooked. By striking the right balance between cost and coverage, you can ensure you are adequately protected while saving money. Remember, knowledge is key when it comes to making informed decisions about your auto insurance coverage limits.

Clarifying Questions

What are auto insurance coverage limits?

Auto insurance coverage limits are the maximum amount your insurance provider will pay for a covered claim. It's essential to choose appropriate coverage limits to ensure you are adequately protected.

How do coverage limits impact insurance premiums?

Coverage limits can directly affect your insurance premiums. Opting for higher coverage limits typically results in higher premiums, while lower coverage limits may reduce your premium costs.

What factors can influence the selection of coverage limits?

Factors such as age, driving history, location, and the type of vehicle being insured can all impact the decision on coverage limits. It's crucial to consider these factors when choosing your coverage limits.

How can you balance the cost of auto insurance with adequate coverage limits?

To balance cost and coverage, consider exploring different insurance providers, adjusting deductibles, and reviewing available discounts. It's important not to sacrifice essential coverage for a lower premium.