When it comes to finding Cheap Auto Insurance That Meets Legal Requirements, it's essential to understand the nuances involved. This guide aims to provide valuable insights and practical tips to help you navigate the world of auto insurance with ease.

Delve deeper into the specifics of coverage options and cost factors to make informed decisions that align with your needs and budget.

Understanding Auto Insurance Requirements

When it comes to auto insurance, each state has specific legal requirements that drivers must adhere to. These requirements typically revolve around the minimum coverage needed for liability insurance, which is crucial for protecting both drivers and other road users in the event of an accident.

Minimum Coverage for Liability Insurance

- In most states, drivers are required to have a minimum amount of liability insurance to cover bodily injury and property damage caused to others in an accident.

- For example, a common requirement is coverage of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage.

- It's important to note that these are just minimum requirements, and drivers may choose to purchase additional coverage for more protection.

Consequences of Driving Without Insurance

- Driving without insurance can have serious consequences, including fines, license suspension, vehicle impoundment, and even legal action.

- Uninsured drivers may also be held personally liable for any damages or injuries caused in an accident, leading to significant financial repercussions.

- Furthermore, uninsured drivers pose a risk to other motorists who may not be adequately compensated for damages if they are involved in an accident with an uninsured driver.

Factors Affecting Auto Insurance Costs

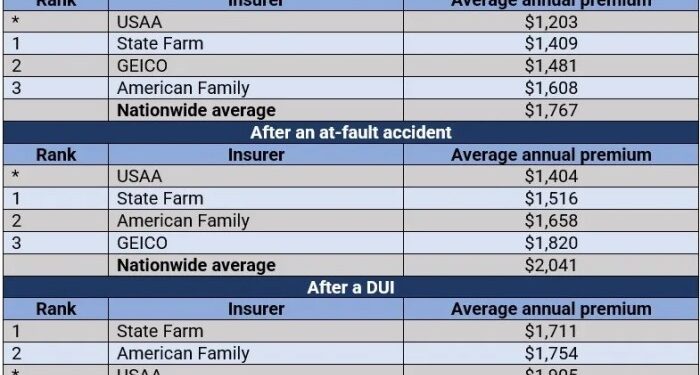

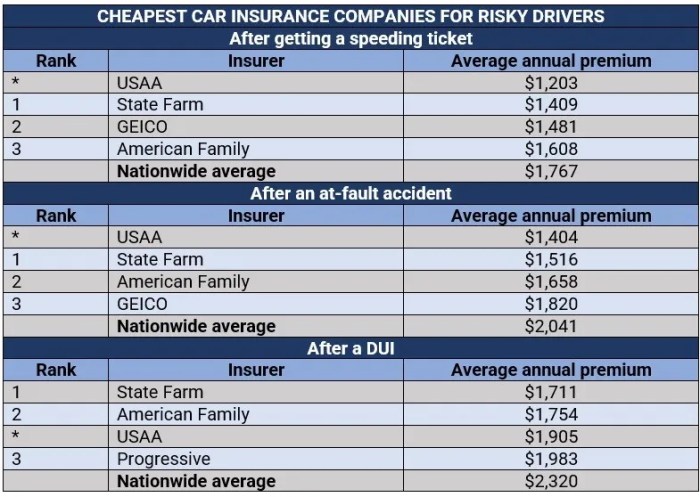

When it comes to auto insurance costs, several factors play a significant role in determining the premiums you pay. Factors such as age, driving record, vehicle type, coverage level, location, and mileage can all impact how much you pay for insurance.

Age, Driving Record, and Vehicle Type

Age, driving record, and vehicle type are crucial factors that insurance companies consider when determining your auto insurance rates. Younger drivers, especially teenagers, typically face higher premiums due to their lack of driving experience and higher risk of accidents. On the other hand, older, more experienced drivers may enjoy lower premiums.A clean driving record with no accidents or traffic violations can also lead to lower insurance rates as it demonstrates responsible driving behavior.

Conversely, a history of accidents or traffic citations can result in higher premiums. Additionally, the type of vehicle you drive can impact your insurance costs. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and increased risk of theft.

Basic Coverage vs. Full Coverage

The level of coverage you choose also affects your auto insurance costs. Basic coverage, which typically includes liability insurance, is generally more affordable than full coverage, which includes comprehensive and collision coverage in addition to liability. While basic coverage meets legal requirements, full coverage offers additional protection for your vehicle and may be necessary if you have a loan or lease on your car.

Location and Mileage

Where you live and how much you drive can also impact your insurance premiums. Urban areas with higher rates of accidents and theft may result in higher insurance costs compared to rural areas. Additionally, the more miles you drive each year, the higher your premiums are likely to be, as increased mileage raises the risk of accidents.Consider these factors when shopping for auto insurance to ensure you find coverage that meets your needs while also being affordable.

Finding Cheap Auto Insurance

When looking for affordable auto insurance that meets legal requirements, there are a few key strategies you can employ to find the best option for your needs without breaking the bank.

Bundling Auto Insurance with Other Policies

One way to potentially save money on your auto insurance is by bundling it with other insurance policies, such as homeowners or renters insurance. Many insurance companies offer discounts to customers who have multiple policies with them, so be sure to inquire about bundling options when shopping for auto insurance

Comparing Quotes from Different Providers

Another effective way to find cheap auto insurance is to compare quotes from different insurance providers. By obtaining quotes from multiple companies, you can compare coverage options and premiums to find the most cost-effective option for your budget. Remember to consider not only the price but also the coverage limits and deductibles offered by each provider.

Understanding Coverage Options

When it comes to auto insurance, understanding the different coverage options available is crucial in ensuring you have the right protection in place. Here, we will explore the various types of coverage options and additional add-ons that can be beneficial for specific needs.

Liability Coverage

- Provides coverage for bodily injury and property damage that you are legally responsible for in an accident.

- Required by law in most states to cover the costs of the other party's injuries or damages.

- Example: If you cause an accident that results in injuries to the other driver and passengers, liability coverage will help cover their medical expenses.

Collision Coverage

- Helps pay for repairs to your own vehicle after a collision with another vehicle or object.

- Optional coverage that can be beneficial if you have a newer car or a vehicle with a higher value.

- Example: If you are involved in a single-car accident where you hit a tree, collision coverage will help cover the cost of repairing your car.

Comprehensive Coverage

- Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Recommended for vehicles that are at risk of theft or damage from weather-related incidents.

- Example: If your car is stolen or damaged in a flood, comprehensive coverage will help cover the cost of repairs or replacement.

Personal Injury Protection (PIP)

- Provides coverage for medical expenses and lost wages for you and your passengers, regardless of fault.

- Required in some states and can be beneficial for covering immediate medical expenses after an accident.

- Example: If you are injured in a car accident and need to cover medical bills and lost wages, PIP coverage will help pay for these expenses.

Outcome Summary

In conclusion, navigating the realm of Cheap Auto Insurance That Meets Legal Requirements doesn't have to be daunting. Armed with knowledge and the right approach, you can secure the coverage you need without breaking the bank.

FAQ Insights

What are the consequences of driving without insurance?

Driving without insurance can lead to fines, license suspension, vehicle impoundment, and legal consequences depending on the state laws. It's crucial to always have the minimum required coverage.

How can location affect insurance premiums?

Location plays a significant role in determining insurance premiums due to factors like crime rates, traffic density, and weather conditions. Urban areas typically have higher premiums compared to rural areas.

What are some examples of additional coverage options?

Examples of additional coverage options include comprehensive coverage, collision coverage, uninsured motorist coverage, and roadside assistance. These can provide extra protection beyond basic liability insurance.