Auto Insurance Quote Mistakes to Avoid in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve into the realm of auto insurance quotes in 2025, it's essential to steer clear of common pitfalls that could impact the accuracy of your quotes and ultimately affect your coverage and premiums.

Common Mistakes When Requesting Auto Insurance Quotes in 2025

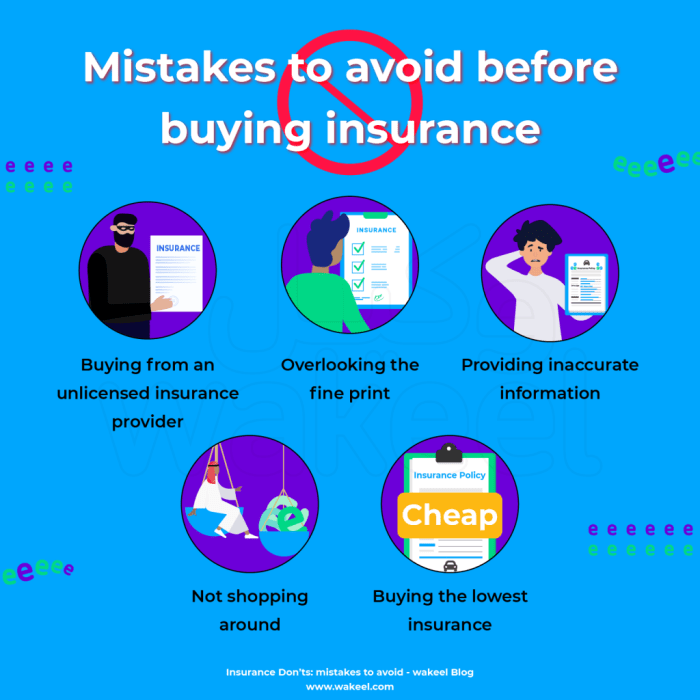

When requesting auto insurance quotes in 2025, it is important to avoid certain common mistakes that can lead to inaccurate quotes. These mistakes can impact the coverage you receive and the premiums you pay. Let's explore three common mistakes people make when requesting auto insurance quotes and how technological advancements may influence the accuracy of these quotes in the future.

Not Providing Accurate Information

One common mistake people make when requesting auto insurance quotes is not providing accurate information about their driving history, vehicle, and personal details. Failing to disclose relevant information can result in quotes that do not reflect the actual risk profile, leading to inaccurate pricing.

As technology advances, insurers may rely more on data analytics and algorithms to assess risk, making it crucial for individuals to provide precise and up-to-date information to receive accurate quotes.

Ignoring Coverage Options

Another mistake is ignoring coverage options when requesting auto insurance quotes. Some individuals may opt for the minimum required coverage without considering additional protection that may be necessary based on their driving habits or vehicle usage. By overlooking coverage options, individuals may receive quotes that do not align with their actual insurance needs.

In the future, advancements in artificial intelligence may help insurers tailor coverage options more effectively, emphasizing the importance of exploring all available choices.

Not Comparing Multiple Quotes

Failure to compare multiple quotes is a prevalent mistake that can result in individuals paying higher premiums than necessary. By only requesting a quote from one insurer, individuals may miss out on potential savings and better coverage options offered by other providers.

With the evolution of online comparison tools and platforms, it is becoming easier for consumers to compare quotes from multiple insurers efficiently. Embracing these tools can help individuals make more informed decisions and secure competitive auto insurance rates.

Importance of Providing Accurate Information for Auto Insurance Quotes

It is crucial to provide accurate information when requesting auto insurance quotes to ensure that you receive the right coverage and premiums that meet your needs and financial capabilities. Inaccurate information can have serious consequences on the policy you are offered and may lead to claim denials or even policy cancellations.

Impact on Coverage and Premiums

Providing inaccurate information such as incorrect driving history, vehicle details, or personal information can result in the insurance company offering you a policy that does not accurately reflect your risk profile. This can lead to inadequate coverage in case of an accident or other unforeseen events.

Additionally, inaccurate information may result in higher premiums if the insurer considers you to be a higher risk based on the incorrect details provided.

Examples of Consequences

- If you provide incorrect information about your driving record and later file a claim, the insurer may deny the claim based on the discrepancies found.

- Inaccurate information about your vehicle's safety features or modifications can lead to a claim denial if the insurer finds out that the details provided were not accurate.

- Providing false information about your address or where the vehicle is parked can result in policy cancellation if the insurer discovers the discrepancies during the investigation process.

Utilizing Online Tools for Accurate Auto Insurance Quotes

When it comes to obtaining auto insurance quotes, utilizing online tools has become increasingly popular due to their convenience and accessibility. These tools offer a quick and easy way to compare rates from different insurance providers, helping consumers make informed decisions about their coverage.

Popular Online Tools for Obtaining Auto Insurance Quotes

- Insurance Comparison Websites: Websites like Insurify, The Zebra, and Compare.com allow users to input their information once and receive quotes from multiple insurance companies.

- Insurance Company Websites: Many insurance companies have online quote tools on their websites that provide instant estimates based on the information provided.

- Mobile Apps: Some insurance companies offer mobile apps that allow users to get quotes, manage policies, and file claims directly from their smartphones.

Comparison of Online Tools vs. Traditional Methods

Compared to traditional methods of obtaining insurance quotes, such as calling individual insurance agents or visiting multiple offices in person, online tools offer several advantages. They provide instant quotes, allow for easy comparison of rates, and can be accessed anytime and anywhere with an internet connection.

However, it's essential to note that the accuracy of online quotes may vary depending on the information provided by the user.

Benefits and Drawbacks of Using Online Tools for Insurance Quotes

| Benefits | Drawbacks |

|---|---|

| Convenience and Accessibility | Potential for inaccuracies if information is not entered correctly |

| Quick Comparison of Rates | May not capture all discounts or customized coverage options |

| 24/7 Availability | Lack of personalized guidance from an insurance agent |

Factors Influencing Auto Insurance Quotes in 2025

In 2025, several key factors will continue to influence auto insurance quotes. Advancements in technology and data analytics are expected to play a significant role in shaping these quotes. Additionally, demographic changes and environmental factors can also impact insurance rates.

Let's delve into these factors in more detail.

Technological Advancements and Data Analytics

Insurance companies are increasingly utilizing technology and data analytics to assess risk and determine auto insurance quotes. By analyzing data such as driving behavior, vehicle usage, and claim history, insurers can tailor quotes to individual drivers. As technology continues to evolve, factors like telematics devices and artificial intelligence will likely play a more substantial role in calculating insurance premiums.

Demographic Changes

Demographic shifts, such as changes in population age, location, and income levels, can also influence auto insurance rates. Younger drivers, for example, may face higher premiums due to their lack of driving experience, while older drivers may benefit from lower rates based on their track record.

Additionally, urban areas with higher traffic congestion and accident rates may result in higher insurance costs compared to rural areas.

Environmental Factors

Environmental factors, such as climate change and natural disasters, can impact auto insurance quotes as well. Increased frequency of extreme weather events can lead to higher claims payouts for insurers, prompting them to adjust rates accordingly. Additionally, areas prone to flooding, wildfires, or other environmental risks may experience fluctuations in insurance premiums based on these factors.

Closing Summary

In conclusion, being mindful of these auto insurance quote mistakes in 2025 can save you from potential headaches and financial setbacks. By providing accurate information and utilizing online tools wisely, you can navigate the insurance landscape with confidence and secure the best possible coverage for your needs.

Common Queries

Why is providing accurate information crucial for auto insurance quotes?

Accurate information ensures that the quotes you receive are tailored to your specific needs, preventing any surprises or discrepancies in coverage.

How do technological advancements impact the accuracy of insurance quotes?

Technological advancements enable insurers to gather more data and assess risks more accurately, leading to more precise quotes for policyholders.

What are some common mistakes people make when requesting auto insurance quotes?

Some common mistakes include providing incorrect personal information, underestimating mileage, and not disclosing previous claims.