Exploring the differences between Cheap Full Coverage Insurance and Minimum Coverage, this introduction sets the stage for an informative discussion that will shed light on the nuances of each type of insurance.

As we delve deeper into the specifics, readers will gain a comprehensive understanding of the benefits, limitations, and cost disparities between these two coverage options.

Understanding Full Coverage Insurance

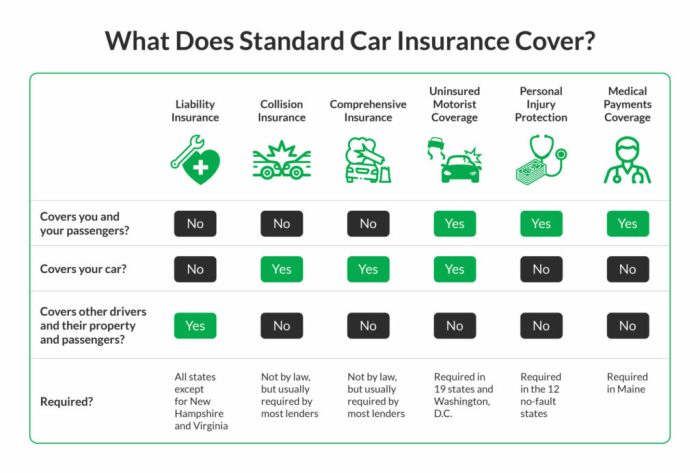

Full coverage insurance is a type of auto insurance policy that includes both liability coverage and comprehensive and collision coverage. While it may cost more than minimum coverage, it provides a wider range of protection for you and your vehicle.

Benefits of Having Full Coverage Insurance

- Protection for Your Vehicle: Full coverage insurance helps cover the cost of repairs or replacement for your vehicle in case of an accident, theft, or natural disaster.

- Medical Expenses Coverage: This type of insurance can also help pay for medical expenses for you and your passengers in case of an accident.

- Peace of Mind: Knowing that you have comprehensive protection can give you peace of mind while driving on the road.

Examples of Situations Where Full Coverage Insurance is Beneficial

- Accidents: In the event of a car accident, full coverage insurance can help cover the costs of repairing or replacing your vehicle, as well as medical expenses for you and your passengers.

- Natural Disasters: If your vehicle is damaged due to a natural disaster like a flood or hailstorm, full coverage insurance can help cover the repair costs.

- Theft: If your car is stolen, full coverage insurance can provide coverage for the loss of your vehicle.

Minimum Coverage Insurance Explained

Minimum coverage insurance typically refers to the basic level of auto insurance required by law in most states. This type of insurance provides the least amount of protection for drivers.

Limitations of Minimum Coverage Insurance

While minimum coverage insurance may meet legal requirements, it often falls short in providing comprehensive protection in various situations:

- Limited Liability Coverage: Minimum coverage insurance usually offers low limits for liability coverage, which may not be enough to cover all damages in an accident.

- No Coverage for Uninsured/Underinsured Motorists: This type of insurance may not include coverage for accidents involving uninsured or underinsured motorists, leaving you vulnerable in such situations.

- Lack of Comprehensive and Collision Coverage: Minimum coverage insurance typically does not include comprehensive and collision coverage, which means you would have to pay out of pocket for damages to your own vehicle in an accident.

Scenarios Where Minimum Coverage Insurance Falls Short

Here are some examples of scenarios where minimum coverage insurance may not provide adequate protection:

- Multi-Vehicle Accidents: In accidents involving multiple vehicles, the costs of damages and injuries can quickly exceed the coverage limits of minimum insurance.

- Severe Injuries: If you or others involved in an accident sustain serious injuries requiring extensive medical treatment, the limits of minimum coverage may not be enough to cover all medical expenses.

- Theft or Vandalism: Minimum coverage insurance typically does not cover theft or vandalism of your vehicle, leaving you responsible for repair or replacement costs.

Cost Comparison

When it comes to comparing the cost of full coverage insurance versus minimum coverage insurance, several factors come into play that can significantly influence the premiums you pay.

Factors Affecting Cost Difference

- The coverage limits you choose: Full coverage typically includes comprehensive and collision coverage in addition to liability, which can drive up the cost.

- The deductible amount: Higher deductibles often result in lower premiums, but this also means you'll pay more out of pocket in the event of a claim.

- Your vehicle's make and model: The type of car you drive can impact insurance costs due to factors like repair costs and theft rates.

- Your driving record: A history of accidents or traffic violations can lead to higher premiums, especially for full coverage.

Driver's Risk Profile Impact

- Drivers with a higher risk profile, such as young or inexperienced drivers, may see a more significant cost disparity between full coverage and minimum coverage.

- Insurance companies assess risk factors to determine premiums, so if you're considered a higher risk, you're likely to pay more for both types of coverage.

Choosing the Right Coverage for Your Needs

Deciding between full coverage and minimum coverage insurance can be a crucial choice that impacts your financial security in the event of an accident. It's important to consider several factors to ensure you have the appropriate level of coverage while balancing cost and protection.

Factors to Consider

- Value of Your Vehicle: If you have a newer or more expensive car, full coverage insurance may be more beneficial to protect your investment.

- Driving Habits: Consider how often you drive, the distance you cover, and the road conditions you typically encounter. If you commute long distances or drive in high-traffic areas, full coverage insurance may provide more peace of mind.

- Financial Stability: Evaluate your financial situation and ability to cover potential out-of-pocket expenses in case of an accident. Full coverage insurance may offer more comprehensive protection but comes with higher premiums.

- State Requirements: Understand the minimum auto insurance requirements in your state to ensure you comply with legal obligations. While minimum coverage is the most affordable option, it may not provide sufficient protection in all situations.

Cost vs. Protection

- Balance is Key: Finding the right balance between cost and protection is crucial when choosing insurance coverage. While full coverage insurance offers broader protection, it comes at a higher cost. Consider your budget and the level of risk you are willing to take.

- Assess Your Needs: Evaluate your individual needs and risks to determine the most suitable coverage level. If you have significant assets to protect or a history of accidents, full coverage insurance may be worth the extra cost.

- Review Policy Limits: Understand the coverage limits and deductibles of each option to ensure you are adequately protected. Compare quotes from different insurance providers to find the best value for your specific situation.

Concluding Remarks

In conclusion, navigating the realm of insurance coverage options can be daunting, but with the insights provided in this discussion, individuals can make more informed decisions tailored to their unique needs.

FAQ Explained

What does full coverage insurance include?

Full coverage insurance typically includes comprehensive and collision coverage, offering extensive protection for your vehicle in various situations.

What are the limitations of minimum coverage insurance?

Minimum coverage insurance usually provides only the basic legal requirements set by the state, which may not be sufficient in more serious accidents or incidents.

How does a driver's risk profile influence the cost disparity between full coverage and minimum coverage insurance?

A driver with a higher risk profile, such as a history of accidents or traffic violations, may face significantly higher premiums for full coverage insurance compared to minimum coverage.