Exploring the world of Homeowners Insurance Quote Options for Rental Properties, this guide delves into the various aspects of insurance coverage for rental properties, providing valuable insights for landlords and property owners alike.

Types of Homeowners Insurance for Rental Properties

When it comes to insuring rental properties, there are various types of homeowners insurance policies available to landlords. These policies offer different levels of coverage and protection based on the type of rental property and the length of time it will be rented out.Landlord insurance is specifically designed for rental properties and typically covers the building itself, liability protection, and loss of rental income.

This type of insurance is essential for landlords who rent out their properties on a long-term basis. On the other hand, regular homeowners insurance may not provide adequate coverage for rental properties, as it is intended for owner-occupied homes.

Short-term Rental Insurance vs. Long-term Rental Insurance

Short-term rental insurance is ideal for landlords who rent out their properties on a temporary basis, such as through platforms like Airbnb or VRBO. This type of insurance typically offers coverage for property damage, liability protection, and loss of rental income due to cancellations.Long-term rental insurance, on the other hand, is more suitable for landlords who have tenants on a long-term lease.

This type of insurance provides coverage for the building, personal property, liability protection, and loss of rental income. It is designed to protect landlords from the risks associated with long-term rental agreements.Overall, the main difference between short-term rental insurance and long-term rental insurance lies in the coverage duration and the specific risks associated with each type of rental arrangement.

Landlords should carefully consider their needs and the type of rental property they own to determine the most appropriate homeowners insurance policy for their investment.

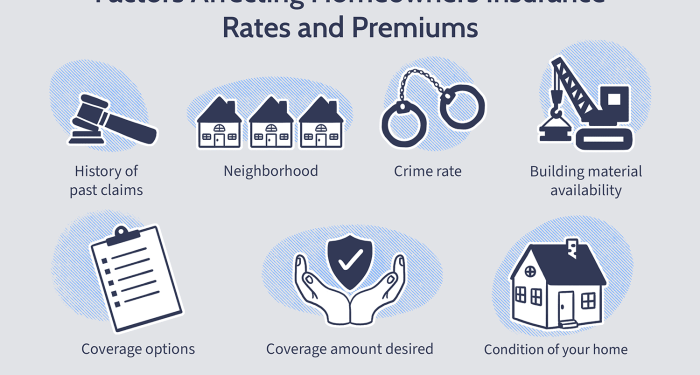

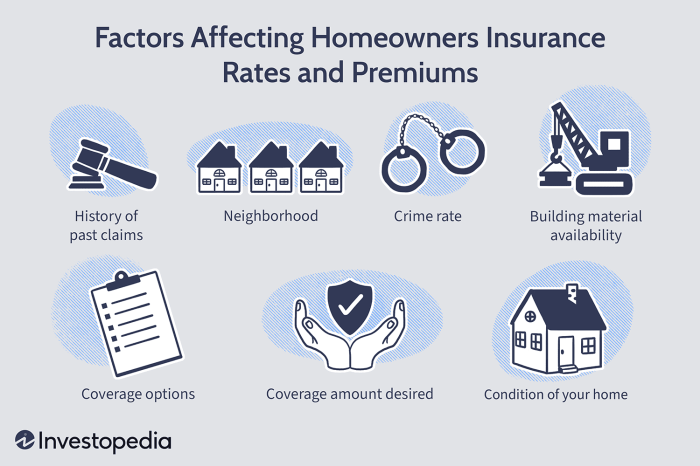

Factors Affecting Homeowners Insurance Quotes for Rental Properties

When it comes to getting homeowners insurance quotes for rental properties, several factors come into play that can impact the cost of coverage. Let's explore some key elements that insurance companies consider when determining insurance premiums for rental properties.

Location of the Rental Property

The location of the rental property is a crucial factor that insurance companies take into account when providing a quote. Properties located in areas prone to natural disasters such as hurricanes, floods, or earthquakes may have higher insurance premiums due to the increased risk of damage.

On the other hand, properties in low-crime neighborhoods or areas with good access to emergency services may have lower insurance costs.

Age and Condition of the Rental Property

The age and condition of the rental property can also influence insurance premiums. Older properties or properties in poor condition may be more susceptible to damage and require higher insurance coverage, leading to higher premiums. Insurance companies may consider factors such as the roof's age, the electrical and plumbing systems, and the overall structural integrity of the property when calculating the insurance quote.

Presence of Amenities like Security Systems or Fire Alarms

Having amenities like security systems, fire alarms, and other safety features in the rental property can positively impact insurance costs. These safety measures reduce the risk of theft, fire, or other potential hazards, making the property less risky to insure.

Insurance companies may offer discounts on premiums for properties with such protective features in place.

Customizing Coverage Options for Rental Property Insurance

When it comes to rental property insurance, landlords have the option to customize their coverage to suit their specific needs and protect their investments effectively.

Optional Coverage Add-Ons for Rental Property Insurance

- Additional Dwelling Coverage: This add-on provides extra protection for the physical structure of the rental property beyond the standard coverage.

- Landlord Liability Insurance: This coverage protects landlords from legal and medical expenses if a tenant or visitor is injured on the rental property.

- Umbrella Insurance: This policy provides additional liability coverage beyond the limits of your standard rental property insurance.

Importance of Liability Coverage in Rental Property Insurance

Liability coverage is crucial for landlords as it protects them from potential lawsuits and financial losses resulting from injuries or property damage that occur on the rental property

Loss of Rental Income Coverage and Its Importance

Loss of rental income coverage ensures that landlords are compensated for lost rental income if their property becomes uninhabitable due to a covered peril, such as fire or water damage. This coverage is essential for landlords to mitigate financial losses during periods of property unavailability.

Tips for Getting Accurate Homeowners Insurance Quotes for Rental Properties

When seeking homeowners insurance quotes for rental properties, it's crucial to provide accurate information to ensure you get the coverage you need. Inaccurate details can lead to inadequate coverage or higher premiums. Here are some tips to help you get precise insurance quotes for your rental property.

Steps to Ensure Accurate Information when Requesting Insurance Quotes

Providing precise information about your rental property is essential when requesting insurance quotes. Here are some steps to ensure accuracy:

- Provide detailed information about the property, including its age, construction materials, square footage, and any additional features like a pool or detached structures.

- Be transparent about the property's occupancy status, whether it's rented out full-time or part-time, or if it's vacant.

- Disclose any recent renovations or upgrades to the property that may impact its value or risk factors.

- Share information about security features such as alarms, deadbolts, and smoke detectors that can help lower insurance premiums.

- Update your insurance provider whenever there are changes to the property to ensure your coverage remains accurate.

Importance of Comparing Quotes from Multiple Insurance Providers

It's essential to compare quotes from multiple insurance providers to ensure you're getting the best coverage at the most competitive rates. Here's why comparing quotes is crucial:

- Each insurance provider may offer different coverage options, deductibles, and premiums, so comparing quotes allows you to find the best fit for your needs.

- By comparing quotes, you can identify any gaps in coverage or excess coverage that you may not need, helping you tailor your policy to your specific requirements.

- Insurance rates can vary significantly between providers, so shopping around ensures you're getting the most cost-effective solution for your rental property.

Insights on Negotiating with Insurance Companies to Get the Best Possible Rates

Negotiating with insurance companies can help you secure the best possible rates for your rental property insurance. Here are some insights on negotiating with insurers:

- Research the market rates and coverage options offered by different providers to have a benchmark for negotiation.

- Highlight any risk mitigation strategies you've implemented on your rental property, such as security systems or regular maintenance, to potentially lower your premiums.

- Consider bundling multiple insurance policies with the same provider, such as auto and rental property insurance, to qualify for multi-policy discounts.

- Ask about available discounts for factors like being a long-term customer, having a good claims history, or paying your premiums annually instead of monthly.

- Don't hesitate to negotiate with your insurer and ask for a better rate, especially if you believe you're a low-risk customer or have taken steps to reduce potential claims on your rental property.

Final Summary

In conclusion, navigating the realm of Homeowners Insurance Quote Options for Rental Properties can seem daunting, but armed with the right knowledge and information, finding the perfect insurance coverage for your rental property can be a smooth and rewarding process.

Clarifying Questions

What are the key differences between landlord insurance and regular homeowners insurance for rental properties?

Landlord insurance typically provides coverage for rental properties, while regular homeowners insurance is designed for owner-occupied homes. Landlord insurance offers protection for rental income and liability risks associated with tenants.

How does the location of the rental property impact insurance quotes?

The location of the rental property plays a crucial role in determining insurance quotes. Properties in high-risk areas for natural disasters or crime may have higher premiums.

What are some optional coverage add-ons for rental property insurance?

Optional coverage add-ons for rental property insurance may include coverage for vandalism, water damage, and coverage for additional structures on the property.