As Term Life Insurance Quotes for Expats and Global Workers comes into focus, this opening passage invites readers into a realm of valuable insights, ensuring an engaging and informative journey ahead.

The following paragraph delves into the specifics of the topic, providing a comprehensive overview.

Term Life Insurance Quotes for Expats and Global Workers

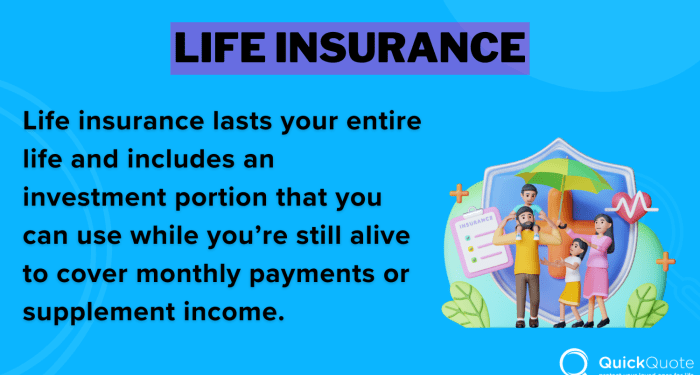

Term life insurance is crucial for expats and global workers as it provides financial protection to their families in case of an untimely death while living or working abroad. It ensures that their loved ones are taken care of and do not face financial hardships.

When comparing term life insurance with other types of insurance plans like whole life or universal life insurance, term life insurance is generally more affordable as it provides coverage for a specific term, usually 10, 20, or 30 years. It does not have a cash value component like whole life insurance, making it a more straightforward and cost-effective option for expats and global workers.

Calculation of Term Life Insurance Quotes

Term life insurance quotes for expats and global workers are calculated based on various factors such as age, health condition, coverage amount, term length, and lifestyle choices. Insurance providers consider the risk associated with insuring individuals living abroad and working in different countries, which may affect the cost of the premium.

Factors Influencing Term Life Insurance Quotes

When it comes to determining the cost of term life insurance for expats and global workers, several key factors come into play. These factors can significantly impact the premiums you will pay and the coverage you will receive.

Age

Age is one of the most critical factors that influence term life insurance quotes. Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered lower risk for insurance companies.

Health Condition

Your health condition also plays a significant role in determining your insurance quotes. Applicants with pre-existing health conditions may face higher premiums or even be denied coverage. Underwriters assess your health through medical exams and health questionnaires.

Occupation

Your occupation can impact your term life insurance quotes, especially if you work in a high-risk job. Jobs that involve dangerous activities or exposure to hazardous environments may lead to higher premiums due to the increased risk of accidents or health issues.

Lifestyle Choices

Certain lifestyle choices, such as smoking, excessive drinking, or engaging in extreme sports, can also affect your insurance quotes. These habits can increase your risk of health issues or premature death, leading to higher premiums.

Coverage Amount and Term Length

The coverage amount you choose and the term length of your policy will directly impact your insurance quotes. Opting for a higher coverage amount or a longer term will result in higher premiums. It's essential to balance your coverage needs with your budget to find the right policy for you.

Understanding Coverage Options

When it comes to term life insurance for expats and global workers, understanding the different coverage options available is crucial in selecting the most suitable plan for your needs.

Types of Coverage Options

- Basic Term Life Insurance: Offers a set payout amount to beneficiaries in the event of the policyholder's death within the specified term.

- Accidental Death and Dismemberment (AD&D): Provides additional coverage in case of accidental death or severe injuries resulting in dismemberment.

- Disability Income Insurance: Offers a replacement income if the policyholder becomes disabled and unable to work.

- Critical Illness Insurance: Pays a lump sum if the policyholder is diagnosed with a critical illness listed in the policy.

It is important to carefully review the terms and conditions of each coverage option to ensure it aligns with your specific needs and circumstances.

Comparison of Coverage Options

| Coverage Option | Coverage Limits | Exclusions | Benefits |

|---|---|---|---|

| Basic Term Life Insurance | Set payout amount | Exclusions for suicide within the first policy year | Financial protection for beneficiaries |

| Accidental Death and Dismemberment (AD&D) | Additional coverage for accidental death or dismemberment | Exclusions for non-accidental deaths | Extra financial security in case of accidents |

| Disability Income Insurance | Replacement income in case of disability | Exclusions for pre-existing conditions | Financial support during periods of disability |

Scenarios for Choosing Coverage Options

- For expats with a high-risk job, opting for Accidental Death and Dismemberment coverage can provide additional peace of mind.

- If a global worker has a family history of critical illnesses, choosing Critical Illness Insurance may be a wise decision.

- Individuals who rely heavily on their income for living expenses may benefit from Disability Income Insurance to ensure financial stability in case of disability.

Tips for Finding the Best Quotes

Finding the best term life insurance quotes as an expat or global worker can be crucial for ensuring financial security for your loved ones. Here are some tips to help you navigate the process effectively.

List of Reputable Insurance Providers

- AXA International

- Cigna Global

- Allianz Worldwide Care

- IMG Global

- Now Health International

Importance of Reading the Fine Print

Before selecting a policy, it is essential to carefully read the fine print and understand the terms and conditions. This will ensure that you are aware of any exclusions, limitations, or requirements associated with the coverage.

Wrap-Up

Concluding our discussion on Term Life Insurance Quotes for Expats and Global Workers, this section encapsulates the key points discussed in a captivating manner, leaving readers with a lasting impression.

FAQ Resource

What factors influence the cost of term life insurance quotes for expats and global workers?

Age, health condition, occupation, lifestyle choices, coverage amount, and term length all play a role in determining insurance quotes.

How can expats and global workers find the best term life insurance quotes?

Research reputable insurance providers catering to expats, compare quotes, and carefully review policy details before making a decision.

What are the different coverage options available in term life insurance for expats and global workers?

Coverage options may include varying limits, exclusions, and benefits tailored to individual needs.